Non essential or impulse buy

High interest

Payments not comfortable

No reasonable end date

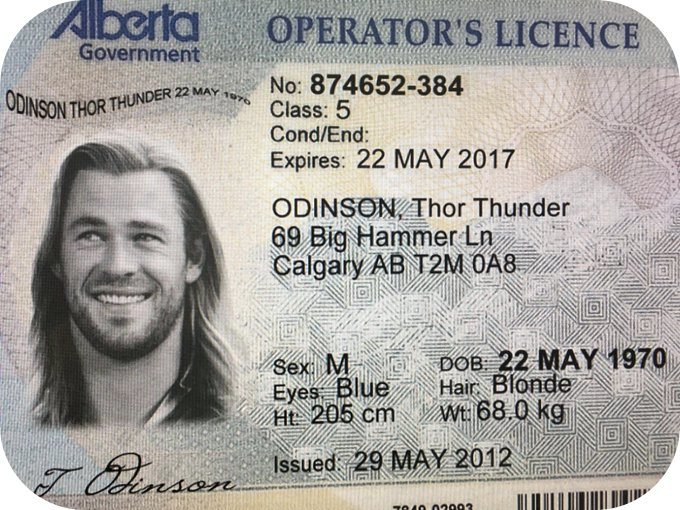

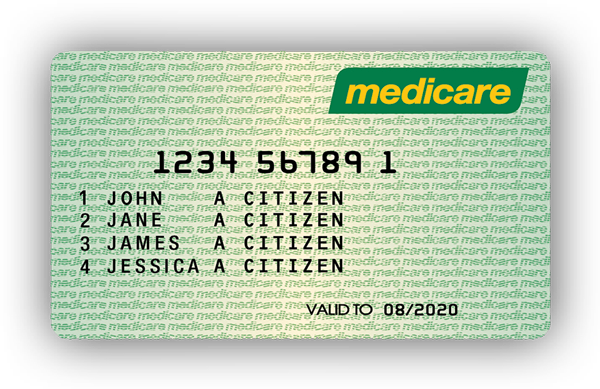

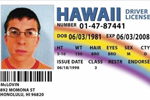

You can open an account online or by visiting a bank or branch in person.You’ll need at least two pieces of Identification, which should total 100 points or more.

Here’s how the points system work:

Birth Certificate

Passport

Citizenship Certificate

Any documentation in which your name and address appears on, this includes:

To make up the full 100 points within the secondary documents category you can add:

Driver’s license 40 points

Passport 70 points

110 Well over but sufficient

Medicare 25 points

Passport 70 points

Phone Bill 25 points

120 Well over but sufficient

A day to-day bank account is often called an ‘Everyday transaction account’ (This is the account you would use to do your everyday banking and withdrawing cash from ATMS or make payments in retail outlets via EFTPOS debit card (also known as a ‘Keycard’)

If you’re not careful, you can rack up quite a few bank fees in Australia.

Most banks charge a variety of fees, so before opening an account you should always be aware of what charges you might have to pay. The most common types of fees:

If you can get a certain number of free transactions per month, try not to exceed this limit.

(my.gov.au)

Australian JobSearch

Australian Taxation Office (ATO)

Centrelink

Medicare

Australian JobSearch

Australian Taxation Office (ATO)

Centrelink

Child Support

Medicare

My health Record

National Disability Insurance Scheme

The ATO will mail your TFN to the postal address on your application.

You can also apply in person at a DHS (Centrelink) or DVA office completing the paper from Tax file number – application or enquiry for individuals (NAT 1432)

You can get a copy of this form by: ordering online at www.ato.gov.au

Superannuation in Australia are the arrangements put in place by governments of Australia to encourage people in Australia to accumulate funds to provide them with an income stream when they retire.

Superannuation (or ‘Super’) is a compulsory system of placing a minimum percentage of your income into a fund to support your financial needs in retirement needs in retirement. Your super is invested in a range of assets to help grow your balance so you can have the best possible retirement outcome.

Calculations are based on the minimum amount of Super your employer must pay on your behalf, known as the “Superannuation Guarantee Contribution” (SGC). The Super Guarantee Contribution rate is currently equal to 9.5% of your ordinary time earnings,

Non essential or impulse buy

High interest

Payments not comfortable

No reasonable end date

Essential item

Low interest

Affordable payments

Debt has an end date

5% = 188.71 x 12 months x 5 years = $11,322.60

6% = $193.33 x 12 months x 5 years = $11,599.80

11% = $217.42 x 12 months x 5 years = $13,045.20

$2 a day

$60 a month

$730 a year

$3,650 after 5 years